41+ can i deduct mortgage insurance premiums

My post below has more details or you can check out this section of IRS Publication 936. Web A big caveat.

Is Pmi Mortgage Insurance Tax Deductible In 2022 Refiguide Org Home Loans Mortgage Lenders Near Me

Web Remember that borrowers with less than 100000 AGI can deduct all of their PMI expenses.

. Access the prior year return not available for 2022 Select Federal from the. Web You can only deduct the out-of-pocket portion of your employer-sponsored health insurance premium if you take the itemized deduction on your tax return. If you are claiming itemized.

Be aware of the phaseout limits however. So if you paid 2000 in upfront PMI premiums on Jan. Learn more on the IRS site.

Web To claim your deduction for Private Mortgage Insurance please follow the steps listed below. The PMI tax deduction works for home purchases and for refinances. Web Answer In general you can deduct mortgage insurance premiums in the year paid.

You could deduct another 286 for tax year 2020. Web That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if single a joint filer or head of. How do you know if your PMI qualifies for.

Web Can I deduct private mortgage insurance PMI or MIP. Web Yes through tax year 2020 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. Remember the deduction is only good through tax year 2020.

The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI. The itemized deduction f See more. SOLVED by TurboTax 5841 Updated January 13 2023.

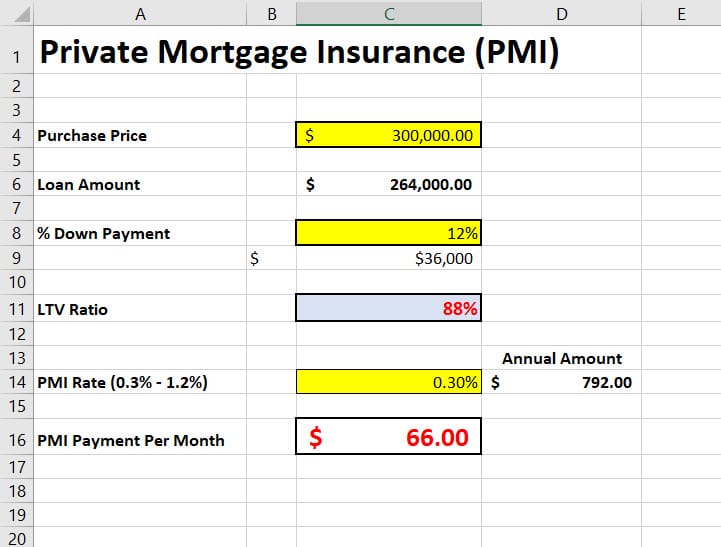

But deducting the rest depends on whether Congress extends the provision beyond 2020. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. Claiming Your Deductible Mortgage Insurance Premiums.

Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses. Web Mortgage insurance premiums are tax-deductible as an expense incurred when renting out dwellings. Web No longer deductible in 2022.

Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. At one time the last year that the tax deduction for private mortgage insurance PMIHowever The Further Consolidated Appropriations Act of 2020 allowed MIP and PMI tax deductions for 2020 and 2021 and retroactively for 2018 and 2019 if qualified taxpayers filed an amended federal tax return. You can deduct the entire portion of this expense if the.

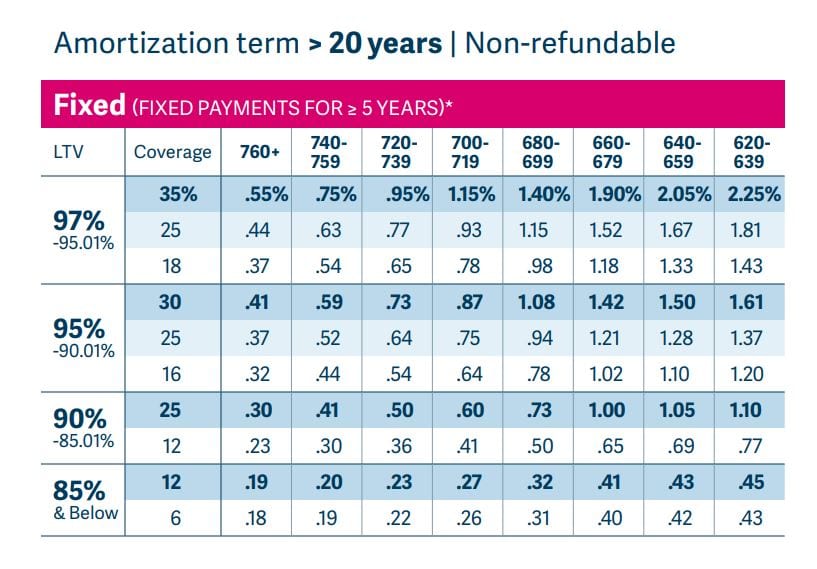

Web Not everyone can take advantage of the deduction for qualified mortgage insurance premiums MIP. ITA Home This interview will help. Report the deduction on line 9 of Schedule E Form 1040 Supplemental.

For example if you pay PMI private mortgage insurance on a conventional loan you can. The itemized deduction for mortgage insurance premiums has expired and you can no longer claim the deduction for tax year 2022. Web MIPs are typically tax-deductible but there are some exceptions.

However if you prepay the premiums for more than one year in advance for each year of coverage you can deduct only the part of the premium payment that will apply to that year. Whether you qualify depends on both your filing status and adjusted gross income AGI. Web Yes unfortunately you will miss out on deducting the rest of the Mortgage Insurance Premiums if you refinanced before the 84th month.

1 2019 you might be able to deduct 286 on your 2019 taxes 2000 84 x 12.

Is Mortgage Insurance Tax Deductible Bankrate

Can You Deduct Mortgage Pmi On Your Tax Return Pinewood Consulting Llc

Homeownership After The Tax Cuts And Jobs Act The Cpa Journal

2021 Long Term Care Deduction Limits Forbes Advisor

Mortgage Hacks To Painlessly Pay Your Mortgage Off Early

Can I Deduct Mortgage Insurance Premiums From Rental Property Sapling

What Is Mortgage Insurance Mortgage Rates Mortgage News And Strategy The Mortgage Reports

6 Insurance Quote Templates Pdf

Can You Deduct Mortgage Pmi On Your Tax Return Pinewood Consulting Llc

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Drs A

Is Mortgage Insurance Tax Deductible

Business Credit

Mortgage Insurance Paid Upfront The New York Times

Can I Deduct Mortgage Insurance Premiums From Rental Property Sapling

How To Calculate Private Mortgage Insurance Pmi Excelbuddy Com

Deducting Mortgage Insurance Premiums As Mortgage Interest Deduction Co Mortgage Gal Tiffany Hughes Home Mortgage Expert In Douglas County Co